Insurance companies increasingly drop homes throughout San Diego County as fire risks rise. Why this matters: The City of San Diego is required by the state to add housing and wants to make it affordable. At the same time, climate change is increasing wildfire risk and insurance companies are dropping policies at increasing rates in urban and suburban neighborhoods in addition to rural communities.

From inewsource: The threat of wildfire is increasingly leading insurers to drop the policies of San Diego homeowners, a trend most prominent in the county’s rural areas but also affecting city neighborhoods from Scripps Ranch to Hillcrest [and in the University City neighborhood too].

Seven out of 10 insured homes in San Diego County were located in ZIP codes where insurers increased the share of policies they dropped from 2015 to 2019, according to an inewsource analysis of the most recently available California Department of Insurance data.

The biggest single-year jump came in 2019, when insurers dropped 3.7% of all homeowners policies countywide, up from 2.3% in 2018.

- Read the entire story from inewsource at: https://inewsource.org/2021/09/03/insurers-drop-homes-as-fire-worries-mount/

- Look up a list of insurance companies and a list of agents and brokers available near you using a tool developed by the California Department of Insurance at: https://interactive.web.insurance.ca.gov/apex_extprd/f?p=400:50

- Find out more about the University City Fire Safe Council at https://www.universitycitynews.org/fire-safe-council-university-city/

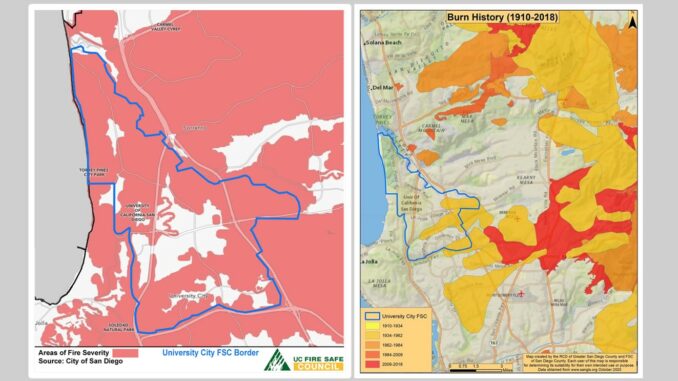

Note: The illustration Fire Severity and Fire Burn History maps are from the University City Community Wildfire Protection Plan (CWPP) which was created by the University City Fire Safe Council and is available for review and download at https://www.universitycitynews.org/fire-safe-council-university-city/